Running an inflatable rental business comes with risks that general insurance often doesn’t cover. Injuries, equipment damage, and venue requirements can lead to significant financial burdens without the right insurance. Here’s what you need to know:

- General Liability Insurance: Covers bodily injury and property damage claims. Most venues require $1–2 million in coverage.

- Equipment Coverage (Inland Marine Insurance): Protects your inventory during transport or against theft, fire, and vandalism.

- High-Risk Equipment Coverage: Needed for larger inflatables or mechanical attractions like inflatable water slides or obstacle courses.

- Local and Venue Requirements: States and venues may require specific liability limits and compliance stickers.

- Additional Coverages: Consider participant accident insurance, commercial auto, and umbrella policies for extra protection.

Insurance costs vary based on coverage limits, business size, and claims history. Premiums for general liability typically range from $300 to $800 annually, but bundling policies or maintaining safety records can reduce costs. Always verify exclusions, claims processes, and provider reliability before purchasing.

Key takeaway: Adequate insurance safeguards your business from financial risks and ensures compliance with venue and legal requirements.

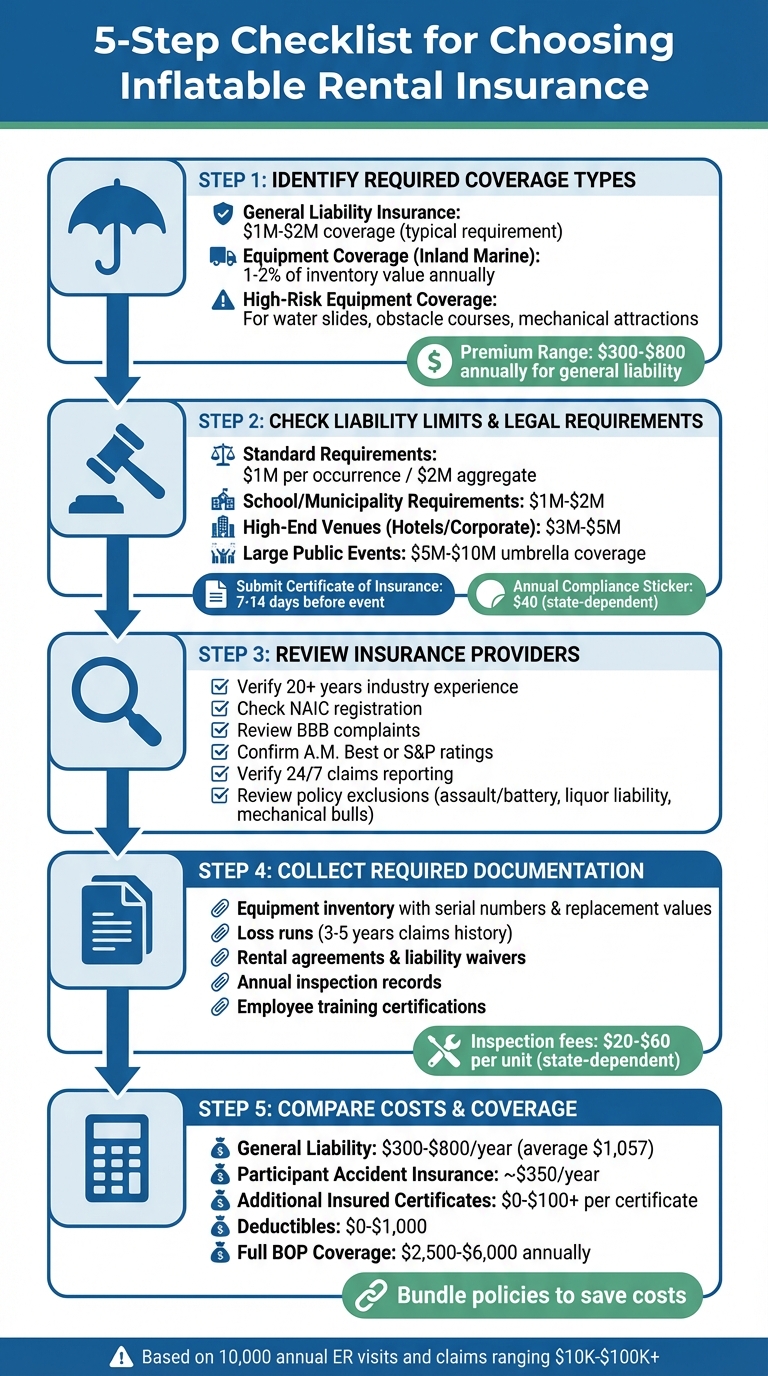

5-Step Checklist for Choosing Inflatable Rental Insurance Coverage

Step 1: Identify Required Coverage Types

Standard homeowner’s or business insurance policies aren’t designed to handle the unique risks of inflatable rentals. These rentals involve equipment that moves between locations and hosts active participants, making specialized coverage essential. Each type of insurance addresses specific risks to help keep your business protected.

General Liability Insurance

General Liability Insurance forms the backbone of your coverage, protecting against claims involving bodily injury or property damage. For instance, if a child twists an ankle on an inflatable or if a unit tips over and damages property, this insurance can help handle the claims. Coverage limits typically range from $1 million per occurrence to $2 million aggregate, and many venues require a Certificate of Insurance. This document often needs to name them as an "Additional Insured" and be submitted 7–14 days before an event.

Equipment Damage Coverage

Inland Marine Insurance is specifically designed to protect your equipment from hazards like theft, fire, vandalism, or damage during transport and setup. Unlike standard property insurance, this coverage moves with your equipment wherever it goes. For example, in February 2026, thieves broke into a storage unit and stole several items, including four commercial bounce houses, three industrial blowers, two generators, and anchoring equipment – valued at $41,700. Thanks to Inland Marine coverage, the business received full reimbursement within two weeks and quickly resumed operations. Most operators carry coverage ranging from $25,000 to $75,000, with annual premiums typically costing 1–2% of their total inventory value.

High-Risk Equipment Coverage

While standard bounce houses (like 13×13 units) are considered low-risk, larger and more complex inflatables require extra coverage. This includes items like water slides, obstacle courses, slip-and-slides, and combo units. Mechanical attractions, such as mechanical bulls, often need separate policies because they’re excluded from standard coverage. High-profile venues, such as hotels or corporate offices, may demand liability limits of $3 million to $5 million, while large public events might require umbrella policies ranging from $5 million to $10 million. To ensure your premiums are calculated accurately, provide your insurance provider with a detailed inventory that includes each unit’s dimensions and notes whether it uses water.

Step 2: Check Liability Limits and Legal Requirements

Research Local Regulations

Inflatables fall under the category of amusement rides, meaning they are subject to specific state laws regarding insurance and annual inspections. For instance, Texas mandates Class B amusement rides to have liability coverage of at least $1,000,000 for bodily injury and $500,000 for property damage per incident. Additionally, each inflatable must display a compliance sticker, which costs $40 and needs to be renewed every year.

However, it’s not just state laws you need to consider – venues often have their own insurance requirements. For example, Michigan State University updated its vendor policies in February 2026, requiring inflatable providers to carry Commercial General Liability insurance with a minimum of $1,000,000 per occurrence and $2,000,000 general aggregate. They also demand $1,000,000 in Automobile Liability and $500,000 in Employers Liability. On top of that, they prohibit high-risk activities like mechanical bulls, ziplines, and bungee jumping on campus.

If you’re working with municipalities or parks departments, they usually require proof of insurance 14 to 30 days before an event to issue permits. To avoid disruptions, set reminders 30 to 60 days before your policy expires so you can renew your Certificates of Insurance on time and secure your seasonal bookings.

Determine Precise Coverage Limits

The amount of coverage you need depends on factors like the size of your inventory, how often you rent out equipment, and the types of events you serve. While $1,000,000 per occurrence and $2,000,000 aggregate are common starting points, some venues or events may require higher limits. For example, schools and municipalities often ask for coverage in the $1,000,000 to $2,000,000 range, while high-end venues like hotels or corporate offices may expect $3,000,000 to $5,000,000.

Liability claims can vary widely, from $10,000 to over $100,000, which could easily bankrupt an uninsured business. With approximately 10,000 bounce house-related emergency room visits annually in the U.S. and 479 wind-related injuries plus 28 deaths worldwide from 2000 to 2021, having sufficient insurance is non-negotiable.

When planning your coverage, consider bundling policies like general liability, commercial auto, and property insurance to save on premiums. If you use delivery vehicles, keep in mind that commercial auto insurance is required in 49 states, and many businesses opt for a $1,000,000 combined single limit. For large-scale public events or festivals, umbrella coverage ranging from $5,000,000 to $10,000,000 may be necessary to cover additional risks.

Step 3: Review Insurance Providers

Once you’ve determined your coverage needs, it’s time to evaluate insurance providers that specialize in the inflatable rental industry.

Verify Industry Experience

Not all insurers understand the unique risks associated with inflatable rentals. You’ll want a provider with significant experience in this niche, not just a general small business insurer. Seek out brokers who offer tailored programs through established carriers like Hudson Insurance Group, which cater specifically to inflatable rentals. Providers with 20+ years of experience in this field are more likely to understand challenges such as wind-related incidents, improper setup claims, or disputes over venue damage.

Ensure the provider is registered with the National Association of Insurance Commissioners (NAIC) to confirm they’re licensed in your state. You can also check their financial stability by reviewing investor relations disclosures – reliable insurers should openly share financial statements to demonstrate their ability to handle large claims. Additionally, look for endorsements from organizations like the National Federation of Independent Business (NFIB), as these often indicate a strong reputation.

"An established provider with a proven track record offers tailored solutions that suit the unique needs of the inflatable rental sector." – Titan Inflatables

Examine Policy Exclusions

Standard liability policies often leave out crucial coverage areas for inflatable rental businesses. For example, many inexpensive policies exclude assault and battery coverage at events, liquor liability if alcohol is served, or damage to property under your "care, custody, or control" – such as scratches on a client’s driveway during setup. If your offerings include mechanical bulls or similar attractions, these are frequently excluded as well.

You should also confirm whether damages during loading and unloading are covered, as these may fall under commercial auto insurance rather than general liability. Other exclusions to watch for include environmental issues like chemical runoff from cleaning supplies and communicable disease claims, including those tied to pandemics. Weather-related damage can be another gray area – some policies won’t cover equipment destroyed by predictable storms or high winds.

"Opting for cheap insurance might seem financially prudent until you face a claim that exposes the gaping holes in coverage." – Rick J Lindsey, XINSURANCE

It’s also essential to have your liability waiver language reviewed by the provider. Many insurers require specific wording for participant waivers to ensure injuries are covered. Once exclusions are clear, assess whether the claims process aligns with your business needs.

Check Claims Process and Customer Support

A good insurance policy is only as reliable as the claims process behind it. Quick and efficient claims processing is critical to keeping your business running smoothly. Before committing, ask about average claim turnaround times and the documentation required for payouts. Check the Better Business Bureau (BBB) for complaints regarding billing or customer service.

Financial stability is another key factor. Use independent rating agencies like A.M. Best or Standard & Poor’s to confirm the insurer can handle large settlements – potentially exceeding $100,000. Make sure the provider offers 24/7 claims reporting and has a dedicated support team.

For extra assurance, call their support line to evaluate wait times and the knowledge of their representatives. You can also join industry-specific Facebook groups like "Party Rental Knowledge Group" or "Bounce House Business Success Group" to get feedback from other operators about their experiences with different insurers.

"Shop around for a good broker you trust who works with a lot of businesses and markets so they can find the best price for you." – Luna Tolunay, CSEP, Fun Planners

Step 4: Collect Required Documentation

Once you’ve chosen an insurance provider, it’s time to gather the necessary documents to streamline the policy approval process. Having your paperwork in order not only speeds things up but also demonstrates your commitment to safety and compliance – key factors for any successful inflatable rental business. Insurance companies need to confirm that your operations are both safe and legal, so being well-prepared can make a big difference.

Business Documentation Needed

To get started, you’ll need to provide several key documents:

- Equipment inventory: This should be a detailed list of all the units you own. Include important details like serial numbers, manufacturer information, purchase dates, and the current replacement value of each item. Keeping this document stored digitally makes it easier to update and share when needed.

- Loss runs: These are official reports from your previous insurance carriers that outline your claims history over the last 3 to 5 years. It’s a good idea to request these from your current agent well before your policy expires since insurers require this written proof.

"We need to see your loss runs to get a clear picture of your claims history, to verify prior insurance coverage for underwriting purposes, to look for patterns of frequency or severity of loss." – Cossio Insurance Agency

You’ll also need operational documents, such as rental agreements, liability waivers signed by customers, and incident reports and accident prevention. Additionally, insurers will ask for basic business details like your annual revenue, the number of employees, and any vehicles used to transport equipment. For new businesses, insurance premiums typically start at around $1,790, as estimated in early 2019.

Finally, make sure your safety measures are well-documented.

Safety and Inspection Records

To meet regulatory and insurance requirements, you’ll need to maintain thorough safety records. These should include logs of daily inspections, repairs, and routine maintenance. Using a standard checklist for each event can help ensure that critical safety steps – like anchoring and surface checks – are consistently followed. In many areas, inflatables are considered amusement rides and must undergo annual registration and safety inspections to legally operate. For instance, in Oklahoma, inspections and registrations are valid for the calendar year (January 1st to December 31st), and you must give at least 72 hours’ notice to schedule a state inspection.

Employee training and certifications are equally important. Keep records of completed training programs, certifications, and safety protocols. These documents can help lower your risk profile, which might even reduce your insurance premiums. Moreover, schools, municipalities, and parks often require a Certificate of Insurance (COI) and proof of inspection before allowing equipment setup. Be sure to request your COI from your insurance provider at least 7 to 14 days in advance to meet any permit deadlines.

Inspection fees will vary depending on your location. For example, Oklahoma charges $20 per unit for registration and $60 per ride for inspections, while Massachusetts charges $40 for small inflatable devices. Having a clear understanding of these costs can help you plan accordingly.

Step 5: Compare Costs and Coverage

Now that you’ve identified your coverage needs and gathered all necessary documentation, it’s time to weigh insurance costs against the protection provided. While it might be tempting to go for the cheapest option, lower premiums can sometimes mean gaps in coverage or unexpected fees. Breaking down all associated costs is crucial to understanding the real price of your policy.

Calculate Total Insurance Expenses

The annual premium is just the starting point. You also need to account for deductibles (the amount you pay before coverage kicks in), fees for additional insureds (charges for adding venues or clients to your policy), and audit adjustments if your revenue or payroll exceeds initial estimates during the policy period.

For bounce house businesses, general liability insurance typically ranges from $300 to $800 per year for $1 million in coverage. However, the average small business pays closer to $1,057 annually. Keep in mind that a lower premium often comes with a higher deductible. For example, some policies require a $1,000 deductible, while specialized providers may offer a $0 deductible for bodily injury or property damage, which can reduce your out-of-pocket expenses.

If your business frequently works with schools or parks, pay attention to additional insured endorsements. Some insurance carriers charge $100 or more per certificate, while others provide unlimited certificates at no additional cost. These fees can add up quickly if you’re working with multiple venues.

You might also consider Participant Accident Insurance, which costs approximately $350 per year. This optional coverage helps cover minor medical costs, like broken bones, without needing proof of negligence. It can prevent small incidents from escalating into costly liability claims that could raise your future premiums. Alex Cossio, Area Vice President of Replacement Services, explains:

"Claims can take years to resolve, leaving an open loss on your record, which may significantly increase premiums (e.g., from $5,000 to $25,000+ annually)".

Balance Coverage Against Cost

Once you’ve calculated all expenses, compare them to the level of protection each policy offers. A budget-friendly policy might seem appealing, but it could leave out critical protections. For instance, some low-cost policies exclude coverage for medical payments, product liability, or personal and advertising injury – areas that could be essential for your business.

Pay close attention to the per occurrence limit (the maximum payout for a single claim) and the general aggregate limit (the total payout during the policy term). Standard limits in the industry are $1 million per occurrence and $2 million aggregate. A policy offering these limits, along with a $0 deductible and free additional insured certificates, might cost around $1,175 annually. While this may seem higher upfront, it often provides better value compared to a cheaper policy with a $1 million aggregate, $1,000 deductible, and $100-per-certificate fees.

"The price is something you need to compare after you make sure the company is reliable. Doing it the other way around will not be smart." – Reservety

Lastly, explore bundling options. A Business Owner’s Policy (BOP) combines general liability with property and business interruption insurance, often at a lower cost than purchasing separate policies. Bundling not only simplifies your paperwork but can also reduce costs, with full coverage typically ranging between $2,500 and $6,000 annually.

Conclusion

Choosing the right insurance for your inflatable rental business isn’t just a formality – it’s a safeguard against potentially devastating financial risks. Negligence claims alone can range from $100,000 to $500,000, and in 2012, the Consumer Product Safety Commission reported over 18,000 bounce house-related injuries. These numbers highlight why adequate coverage is essential.

"Bounce house insurance is more than a business expense – it’s an investment in your company’s future. Comprehensive coverage ensures that a single incident won’t destroy what you’ve built".

This guide has walked you through the key types of coverage – like General Liability, Property Insurance, Commercial Auto, and Workers’ Compensation – and emphasized the importance of meeting liability limits of $1 million to $2 million, a common requirement for schools and municipalities. Partnering with insurance specialists who understand the unique risks of the inflatable rental industry is equally important. They can help you avoid policies with hidden loopholes or inflated premiums. Additionally, maintaining thorough safety and sanitization records, equipment inspection logs, and signed liability waivers not only strengthens your claim process but can also lead to better insurance rates.

"The last thing you want to do is get a policy that you believe has all of your bases covered. Finding out you aren’t covered when you go to make a claim is quite disconcerting".

To make sure your policy truly protects your business, verify your provider’s state licensing through the State Insurance Department or NAIC. Check their financial stability and complaint history to ensure they can handle major claims. And don’t be swayed by the lowest price – scrutinize deductibles, exclusions, and fees for additional insured certificates to understand the full cost of your coverage.

At Bouncy Rentals USA (https://bouncyrentalsusa.com), we know that comprehensive insurance is as important as the joy we bring to our customers. With the right policy and solid documentation practices, you’ll not only meet the standards required by schools, parks, and corporate clients but also secure the financial protection your business needs to thrive, no matter what challenges come your way.

FAQs

What insurance do I need for water slides or obstacle courses?

You’ll need liability insurance to protect yourself in case of injuries or property damage when renting out water slides or obstacle courses. Many venues, such as parks or recreation centers, require this coverage as part of their policies. It not only keeps you compliant but also ensures you’re safeguarded against unexpected issues.

How do I know if a venue will accept my COI?

To determine if a venue will accept your Certificate of Insurance (COI), start by reviewing their insurance requirements. These are typically detailed in your rental agreement or provided separately by the venue. Make sure your COI aligns with their specified coverage limits, lists any necessary additional insured parties, and is up to date. It’s a good idea to confirm with the venue ahead of time to ensure everything is in order. Keep both their requirements and your COI on hand for easy reference.

What exclusions should I check for before I buy a policy?

Before buying a policy, take a close look at the exclusions. These often include things like product defects, intentional damage, injuries caused by reckless or intoxicated individuals, and damages that happen outside the rental period. Knowing these details can help you make sure your inflatable rental business is properly covered.