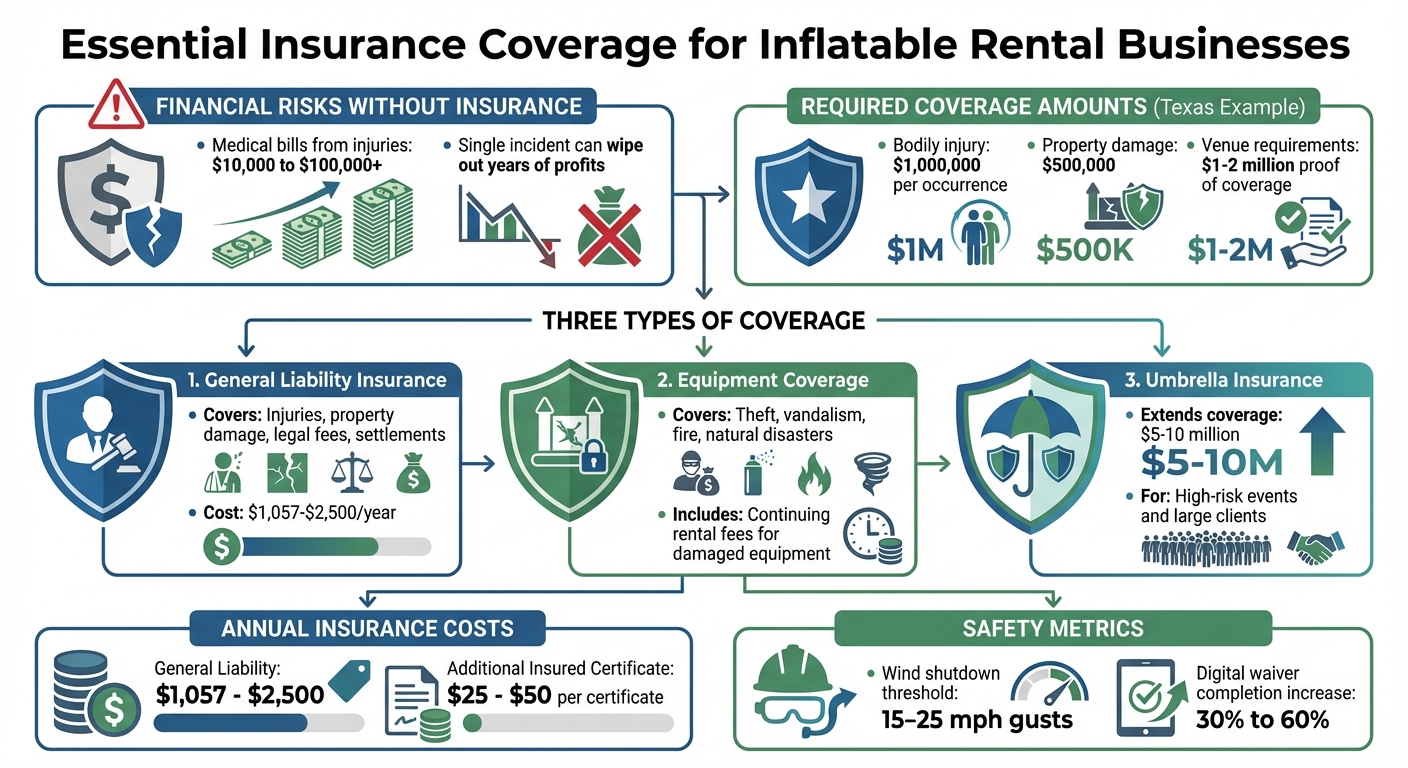

Liability insurance is a must for inflatable rental businesses to avoid financial risks from accidents, injuries, or property damage. Without it, a single incident could lead to expenses ranging from $10,000 to over $100,000. Many states, such as Texas, legally require insurance for inflatables, classifying them as "amusement rides." Venues often demand proof of $1–$2 million in coverage before allowing rentals.

Key points:

- General Liability Insurance: Covers injuries, property damage, legal fees, and settlements. Costs range from $1,057 to $2,500 annually.

- Equipment Coverage: Protects inflatables from theft, vandalism, or natural disasters (not covered by general liability).

- Umbrella Insurance: Extends liability limits for high-risk events or larger clients.

- Safety Practices: Regular inspections, digital compliance tools, and customer education reduce risks.

- Example: Bouncy Rentals USA combines insurance, maintenance, and professional setup to ensure safety and client confidence.

For a secure and smooth rental experience, always verify insurance coverage and safety protocols with your provider.

Inflatable Rental Insurance Coverage Requirements and Costs

Why Liability Insurance Matters for Inflatable Rentals

Protection from Financial and Legal Claims

Running an inflatable rental business comes with risks, and a single accident can wipe out years of hard-earned profits if you’re not prepared. For example, medical bills from bounce house injuries can range from $10,000 to over $100,000, depending on the severity. General liability insurance helps cover these hefty costs, ensuring your business remains financially stable. Beyond injuries, this type of policy also protects against incidents tied to operational mishaps.

Legal fees can add up quickly if you’re taken to court. Liability insurance steps in to cover attorney fees and court costs, sparing your business from having to shoulder these expenses alone. Property damage claims are another critical concern. Imagine your crew accidentally damaging a client’s lawn, breaking fixtures, or even causing structural damage to a building. Without insurance, you’d be paying for these repairs out of pocket, which could severely harm your bottom line. With the right coverage, however, these costs are taken care of, allowing you to focus on running your business.

This level of financial protection also ensures you comply with legal standards, which is essential for staying operational.

Meeting Local Insurance and Safety Requirements

To operate legally, inflatable rental businesses must meet specific insurance requirements set by state and local governments. For instance, in Texas, inflatables are classified as Class B amusement rides. This classification requires businesses to carry at least $1,000,000 in bodily injury coverage per occurrence and $500,000 for property damage. Falling short of these requirements can lead to hefty fines or even the suspension of your business.

Additionally, many venues – such as schools, parks, and corporate event spaces – demand proof of sufficient insurance before allowing rentals. These venues often require Certificates of Insurance showing coverage amounts between $1 million and $2 million. They may also ask to be listed as "additional insured" on your policy, which typically costs around $25 to $50 per certificate. Without these documents, you risk losing valuable bookings and partnerships.

Liability insurance isn’t just about protecting your business – it’s about meeting the expectations of clients, venues, and regulators to keep your operations running smoothly.

What Inflatable Rental Liability Policies Cover

Knowing exactly what your insurance covers is essential for safeguarding your inflatable rental business. Most policies include several types of coverage, each tailored to handle specific risks.

General Liability Coverage

General liability insurance is designed to handle bodily injuries (like broken bones, sprains, or concussions) and property damage. It covers medical bills, repair costs, legal fees, and any settlements or judgments that may arise. For small inflatable rental businesses, this type of coverage usually costs between $1,057 and $2,500 annually.

Equipment and Property Coverage

General liability policies don’t cover damage to your inflatables or other equipment. To protect your assets, you’ll typically need separate property insurance or specialized "Rented Equipment to Others" coverage. This insurance shields your business from losses due to theft, vandalism, fire, or natural disasters, whether the equipment is in storage, in transit, or being used at an event. Many policies also include Continuing Rental Fees coverage, which reimburses lost income if damaged equipment is out of service while being repaired.

Umbrella Liability Coverage

Umbrella insurance kicks in when claims exceed the limits of your primary policy. General liability policies often have limits ranging from $1 million to $2 million per occurrence. Umbrella coverage can extend that protection to $5 million or even $10 million, offering critical support in high-stakes situations.

"For additional peace of mind, umbrella policies provide extra liability coverage beyond your standard policy limits. This can be particularly valuable for businesses servicing large events or operating in high-risk environments." – Goodshuffle Pro

This added layer of protection is especially important when working with corporate clients, municipalities, or large-scale events that require higher liability limits. Combining this coverage with digital tools can help you stay compliant and proactively manage risks. This includes staying informed about local safety laws that govern equipment operation and maintenance.

Using Technology and Best Practices to Lower Liability Risks

Rental companies today are turning to digital solutions to streamline compliance and improve safety. By pairing these tools with strong operational protocols, businesses can proactively reduce accidents and maintain detailed records to support their liability strategies.

Digital Tools for Tracking Compliance

Modern digital waiver platforms simplify liability management. They offer secure cloud storage, instant search capabilities, and automated reminders to ensure customers complete necessary forms before events. Many platforms also include identity verification features, like photo capture, to confirm that the person signing the waiver is authorized – such as a legal guardian signing for a minor.

Mobile inspection apps, like GoCanvas, further enhance safety by allowing staff to document daily equipment checks with photos, GPS data, and time stamps. This creates a reliable audit trail to prove equipment was inspected and maintained properly.

"We’ve seen waivers signed during online checkout jump from 30% to 60%, which has been a game-changer for us! Our staff and guests are loving it because there’s no more waiting in endless lines." – Reza Saidi, Venue Manager, Entertainment Park

Safety Protocols for Equipment and Setup

In addition to digital compliance tools, thorough on-site safety practices are essential. Regular inspections and proper setup procedures are critical for preventing accidents. Staff use digital checklists to confirm that blowers, tie-downs, and seams are in good condition. They also inspect for physical damage and ensure equipment is securely anchored with stakes or sandbags.

Monitoring wind conditions is another key step. Dedicated systems or apps track local wind speeds, and clear shutdown protocols are followed during high winds or lightning. Many manufacturers advise deflating inflatables when gusts reach 15–25 mph.

Cleaning and maintenance routines also play a role in reducing liability. Digital logs, complete with photo uploads, document the condition of equipment at setup. These records can be crucial in resolving insurance claims or legal disputes.

Teaching Customers How to Use Inflatables Safely

Educating customers is another layer of protection against accidents. Clear safety instructions not only help prevent injuries but also demonstrate that reasonable precautions were taken. Automated emails or text messages with safety guidelines and instructional videos can be sent as soon as a waiver is signed, ensuring customers are informed before their event.

On-site, staff can provide written safety rules and demonstrate proper use. Key topics include maximum capacity, age restrictions, avoiding rough play, and the importance of adult supervision. Customers should also be made aware of weather-related risks and instructed on when to shut down equipment.

"A digital waiver can not only protect you when a guest gets injured, but also in the event a guest gets injured, declines anything on the spot, and then decides to sue you four months later when they get a large medical bill." – Jessica Malnik, Writer, Xola

How Bouncy Rentals USA Handles Insurance and Safety

Full Insurance Coverage on All Equipment

Bouncy Rentals USA takes safety seriously, which is why they carry comprehensive liability insurance for all their inflatables. Fully licensed and insured, the company operates across Maryland, covering areas like Baltimore City, Baltimore County, Anne Arundel County, Howard County, Montgomery County, and Harford County. This insurance protects both the business and its customers from financial risks related to injuries or property damage during rentals.

"Licensed and insured for your peace of mind" – Bouncy Rentals

Professional Delivery and Setup Service

On top of their insurance coverage, Bouncy Rentals USA ensures safety through their "Full Service" rental model, which includes delivery, setup, and pickup handled by trained professionals. Their team follows strict safety protocols to ensure every inflatable is securely anchored with stakes or weights, minimizing risks like tipping or wind-related accidents. Before any equipment reaches the event site, staff conduct thorough pre-rental inspections of blowers, tie-downs, and seams to identify and address potential hazards.

For added convenience, customers can rely on "Jumpy", a 24/7 virtual assistant that answers safety questions and assists with bookings anytime. While customer pickup is an option for those looking to save on fees, the company strongly recommends using their professional setup service to ensure everything is installed safely and correctly. This hands-on approach underscores their commitment to delivering a secure and stress-free experience.

Focus on Clean Equipment and Clear Safety Instructions

Bouncy Rentals USA prioritizes cleanliness and safety with a meticulous maintenance routine. After every use, each unit is vacuumed, scrubbed with mild soap, sanitized, and fully dried before being stored. These steps help prevent the spread of illness and keep the equipment in top condition. Additionally, all units are regularly inspected and maintained according to manufacturer guidelines, reinforcing their "Safety First" philosophy.

"Safety First: Fully insured and inspected units" – Bouncy Rentals

Customers are provided with detailed safety guidelines, including information on age and weight limits, maximum capacities, and weather precautions. For example, they advise following wind limits for bounce houses and shutting down units, typically when gusts exceed 15 to 25 mph, and emphasize the importance of adult supervision throughout the rental period. These clear instructions, combined with their rigorous safety measures, have earned Bouncy Rentals USA a 5-star rating from hundreds of satisfied customers and the title of "Baltimore’s #1 Bounce House Rentals".

Conclusion

Liability insurance plays a critical role in the operation of inflatable rental businesses, acting as a safeguard against the substantial financial risks these businesses face. With liability claims often ranging from $10,000 to over $100,000, a single incident could lead to overwhelming medical expenses, property damage claims, or legal fees without proper coverage.

When paired with digital compliance tools and strict safety measures, insurance becomes a cornerstone of a solid risk management plan. It’s not just about financial security – it’s also about earning client trust. Many venues, such as schools, parks, and corporate spaces, require proof of insurance before working with a rental provider.

"Insurance is an essential component of operating a successful and responsible inflatable rental business. It protects you from liability claims, property damage, and unforeseen events that could otherwise jeopardize your operations."

For example, Bouncy Rentals USA demonstrates a strong commitment to risk management by maintaining comprehensive liability insurance across all their equipment and service areas in Maryland. Their "Safety First" philosophy goes beyond insurance, incorporating professional delivery, thorough cleaning procedures, and clear safety instructions. This dedication has earned them a 5-star reputation, with customers praising the company for providing both fun and peace of mind.

When planning your next event, always ask for a Certificate of Insurance (COI) and ensure the rental company adheres to professional setup and safety protocols. Choosing a provider that prioritizes liability and safety ensures a secure and enjoyable experience for everyone involved.

FAQs

What insurance limits do venues usually require?

Venues typically mandate liability insurance with limits of at least $1 million per occurrence. However, many venues favor higher coverage levels, such as $2 million per occurrence combined with $10 million in excess liability, to provide stronger safeguards against potential risks.

What does inflatable rental insurance typically exclude?

Inflatable rental insurance typically doesn’t cover everything. For example, it often excludes issues that aren’t related to bodily injury or property damage. This might include certain equipment malfunctions or other exclusions outlined in the policy. Since coverage details can vary by provider, it’s crucial to carefully review your policy to fully understand its limitations.

How can digital waivers and inspection apps reduce liability?

Digital waivers and inspection apps simplify the check-in process while helping to reduce liability for inflatable rentals. By requiring guests to acknowledge risks and provide informed consent, these tools create legally binding documentation that can protect your business. They also ensure safety compliance, making it easier to manage risks and uphold safety standards effectively.